Act Now: New Utility Rebates Announced for 2024!

What are IRA Tax Credits?

The IRA tax credit is a financial incentive created by the Inflation Reduction Act (IRA) to encourage investment in clean energy and reduce carbon emissions. The IRA offers homeowners significant tax credits and rebates for upgrading their home’s essential systems.

The Inflation Reduction Act’s tax credits give you a reason to upgrade! Get rewarded for installing energy-efficient home systems like HVAC, Plumbing, and Electrical. Save money, boost comfort, and reduce your carbon footprint.

What are the IRA Tax Credits for Home Improvements?

Here’s how the IRA Tax Credits can benefit you:

Heating & Cooling

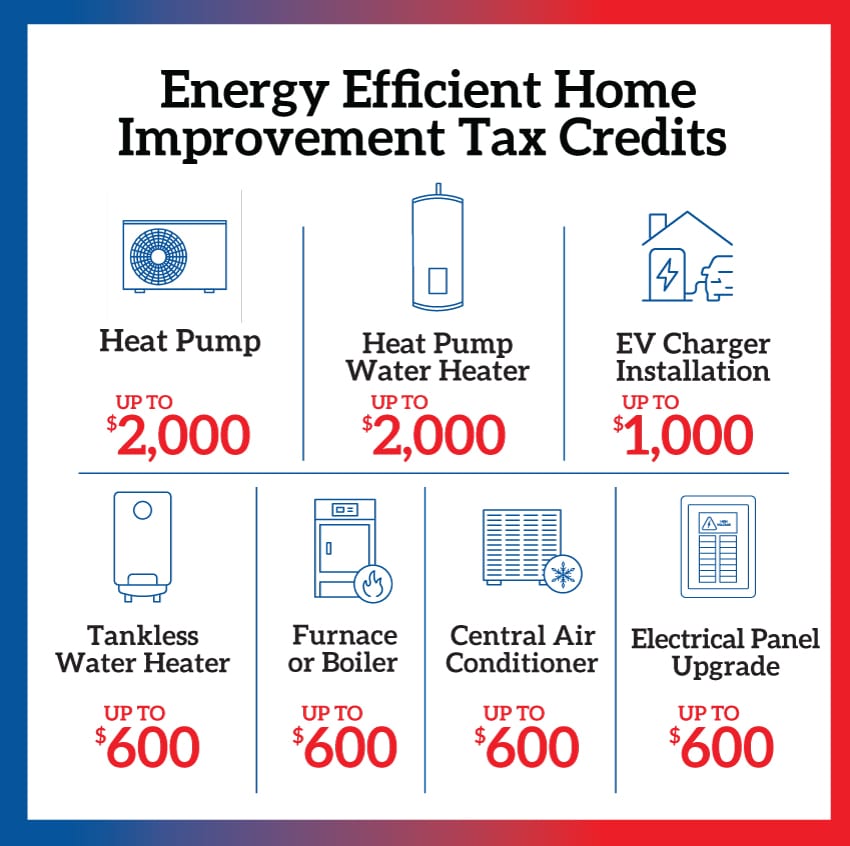

Furnaces, boilers, and central air conditioners are each eligible for up to $600 in IRA tax credits. In addition to the federal tax credit, there are rebates available for different equipment models.

Heat Pumps

Heat pumps are highly efficient, dual-function heating and cooling systems. They move air, rather than generating it from scratch and since they don’t rely on fossil fuel combustion, they leave a lower carbon footprint. Heat pumps are eligible for up to $2,000 in IRA tax credits.

Water Heaters

Bonfe offers several water heater options, including tankless and heat pump water heaters. Traditional and tankless water heaters are eligible for up to $600 IRA tax credit, and heat pump water heaters offer up to $2,000 IRA tax credit.

Electric Panel

Electric panel upgrades are eligible for up to $600 tax credit. There are additional tax credits available for switching to an electric vehicle.

Electric Vehicle Charger Installation

EV charger installations are eligible for up to $1,000 in tax credits. There are additional tax credits available for switching to an electric vehicle.

What are the annual limits for IRA Tax Credits?

You can receive up to $3,200 in eligible IRA tax credits each year, from now until 2033. There is a $2,000 maximum total annual credit for heat pumps and heat pump water heaters and an additional $1,200 maximum total annual credit for furnaces, boilers, central air conditioners, traditional or tankless water heaters, and electric panel upgrades. You can combine projects from these two categories for a total maximum annual credit of $3,200!

Beyond the savings, there are more reasons to upgrade:

- Increased comfort: Enjoy consistent temperature control, better water pressure, and reliable electrical performance.

- Cost Savings: Modern systems are more efficient, leading to significant cost reductions.

- Higher property value: Modernized homes are more attractive to potential buyers.

- Environmental impact: Reduce your carbon footprint with sustainable upgrades.

Ready to take advantage of the IRA’s tax breaks? We’re here to help! Our team of experts can guide you through the process, recommend the best upgrades for your home, and help you maximize your savings.

Contact us today for a free consultation to discuss custom installation options that best fit your home’s needs.

More information about the IRA tax credit program can be found here.

A list of additional utility rebate offers is available here.

File Form 5695, Residential Energy Credits Part II, with your tax return to claim the credit. You must claim the credit for the tax year when the equipment is installed.